Timely and accurate payments help maintain strong relationships with your suppliers. Automation ensures that invoices are processed and paid promptly, reducing the risk of late fees and fostering trust with your vendors. The accounts payable (AP) department is responsible for implementing the entire accounts payable process. The department is also a key driver in supporting the organization as a whole when it comes to vendor payments, approvals, and reconciliations.

Comprehensive Guide to Inventory Accounting

AP automation also provides you better visibility and control over your financial data. Centralizing the AP process for all the departments with predefined processes will help you to eliminate data redundancy and save time on the purchase invoice processing. It will also help to reduce the data entry mistakes and control ordering by employees. This is a crucial step where AP manager need to make sure that purchase invoice or bill has all the relevant information such as vendor name, item details, payment details, etc. CDE company will record this amount as an accounts receivable in their books as this money they will receive from ABC company.

How to Record Accounts Receivables?

The accounts payable are the current liabilities that are shown on the balance sheet for which the balances are due within one year. In this case, the company has an obligation to pay suppliers based on the credit term which is usually shown on the supplier invoices. Credit duration in the credit term is usually 30 days, but it can vary depending on the type of business and the relationship between the company and its suppliers.

- Yes, accounts payable journal entries can be reversed, especially if there are errors or if the liability is no longer valid.

- Still, in larger organisations, several executives will individually be in charge of each phase.

- The accounts payable (AP) department is responsible for implementing the entire accounts payable process.

- In a neighbourhood, Super Electronics offers televisions with larger screens.

- It may also result in payment delays, strained supplier relationships, and difficulty in reconciling accounts.

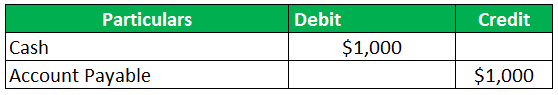

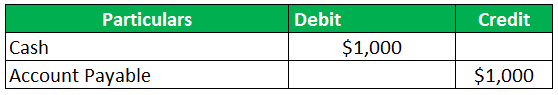

- Proper double-entry bookkeeping requires that there must always be an offsetting debit and credit for all entries made into the general ledger.

Process Payment

If you are not using accounting software, you can calculate your accounts payable by adding the amounts of all the bills that you have maintained physically. For example, the ‘Accounts Payable Aging Summary’ report, not only tells you about the vendors that you owe money to, but it also highlights the invoices against which payments are overdue. You need to keep a track of your accounts payable to know when the payments are due, so you can make the payments to your suppliers on time. For example, if you see that one of your suppliers offers an early payment discount, perform a few quick calculations to see if your cash flow can handle making that payment early. Building this AP report is straightforward if you already have a business expense tracker. Expense management software like Ramp is quick and easy to use and can help you easily build your history of payment report.

Vendor Payments

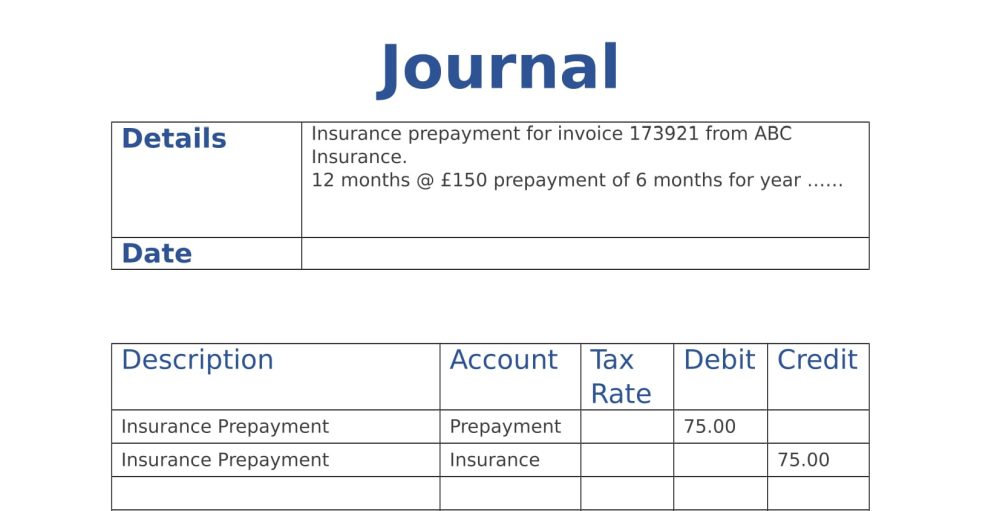

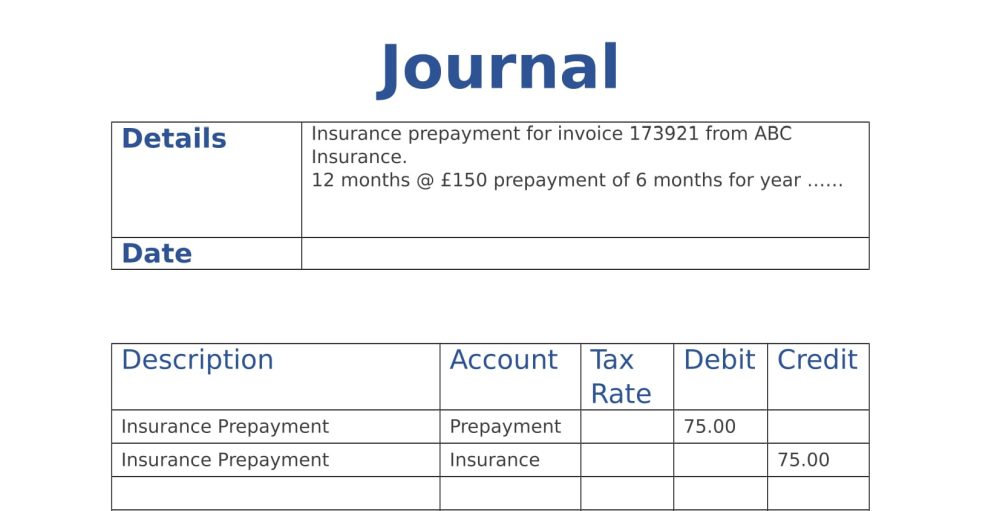

A purchase order is a buyer’s request for goods or services to the vendors. A liability, though, is only noted after the purchases have been delivered and an invoice is sent by the vendor. In cases where assets other than inventory purchases are made from a vendor, the amount is marked as a debit against the relevant asset’s account. Accounts payable journal entry is recorded according to the type of transaction made. It can be recorded against a transaction from an expense account to your accounts payable charge. When you reconcile accounts payable, you’re verifying that the amount owed to suppliers and vendors matches what’s listed in your financial statements.

When a business procures goods or services without immediate payment, an accounts payable journal entry is created to acknowledge this financial obligation. The ending cash balance in March is the beginning cash balance in April. Review your company’s balance sheet and analyze each asset and liability account to determine the impact on cash flow. An AP software helps you to ensure that all payments are matching the purchase orders approved previously with the vendor. AP automation helps to build a cash flow to fill the gaps when cash flow slows, and bills are due. Depending on the size and complexity of the business, accounts payable can have single or multiple sections.

Yes, you can perform your AP tasks without running these reports—it’s certainly possible, and many businesses do. Therefore, the asset account will have ₹40,000 subtracted from it, and the Accounts Payable charge will have ₹40,000 added to it as a credit. Here are examples of Accounts Payable journal entries that will 4 ways to calculate depreciation on fixed assets help us grasp the idea. Make an entry when a payment has been made to the Accounts Payable or the creditor. An entry is produced in the journal whenever a charge is made to the account for services bought. An entry is made on the account whenever there is an acquisition of an asset that is not an inventory item.

In double-entry accounting, a credit is always entered as part of the transaction if there is an increase in Accounts Payable. On the other hand, a growth in Accounts Receivable is never recorded as a credit in the accounting books. In a neighbourhood, Super Electronics offers televisions with larger screens. Accounts Payable manager John has shown interest in presenting an overview of the department’s day-to-day activities. As a result of this process, only valid invoices for the correct amounts will be paid. In the future, Accounts Payable will be responsible for paying all valid invoices.

Errors in accounts payable journal entries can be corrected by identifying the mistake, determining the correct entry, and making a correcting entry. The original entry should be reversed, and a new entry should be recorded with the accurate information. The accounts payable ledger provides a comprehensive record of transactions from a company’s vendors/suppliers and the balances owed to them. This journal entry shows ABC Ltd has increased raw materials by Rs 50,000 by debiting the raw materials account and increased its accounts payable balance by the same amount. This means ABC Ltd. owes its supplier Rs 50,000, which must be paid by 25th June. Any transaction related to purchasing goods or services on credit results in an accounts payable liability.

How to build and manage your AP reporting process

Some people mistakenly believe that accounts payable refer to the routine expenses of a company’s core operations, however, that is an incorrect interpretation of the term. Expenses are found on the firm’s income statement, while payables are booked as a liability on the balance sheet. Although some people use the phrases “accounts payable” and “trade payables” interchangeably, the phrases refer to similar but slightly different situations. Trade payables constitute the money a company owes its vendors for inventory-related goods, such as business supplies or materials that are part of the inventory. Accounts payable include all of the company’s short-term obligations. Accounts payable (AP), or “payables,” refers to a company’s short-term obligations owed to its creditors or suppliers, which have not yet been paid.

Step 1: Identify the Transaction

The accounts payable department should use accrual accounting to post transactions and for financial reporting. If your business is smaller, a bookkeeping employee may handle accounts payable. Many businesses underestimate the importance of accounts payable management and automation. As the AP process is vital for every company, all businesses must spend time on its successful implementation. AP automation is very important to increase efficiency and avoid errors made by manual work.

Discount from Suppliers

- An entry is produced in the journal whenever a charge is made to the account for services bought.

- Both of these categories fall under the broader accounts payable category, and many companies combine both under the term accounts payable.

- A sub-ledger consists of the details of all individual transactions of a specific account like accounts payable, accounts receivable, or fixed assets.

- Accounts receivable are your asset as it is money that your customers owe you in exchange for goods and services purchased on credit.

If someone comes across an unpaid invoice, they can review the ledger to check if it was voided or adjusted before making a payment. When an account is credited, money is “coming from” or “leaving” the account while debits mean money is “entering” the account. The answers to questions about profitability, growth, debt, and more can all be found in financial statements and transaction histories. On 29 July 2019, ABC Ltd. purchases inventory for $2,000 on credit from XYZ Co.

This report serves as a reminder to use those credits and can even remind you to prioritize certain vendors to make use of your available credits. With your expenditures categorized, you can monitor your spending at both a micro and macro level, checking that you’re adhering to operating budgets. As a bonus, you’ll be better prepared to report your deductible expenses during tax time.

A credit memo is a document from a supplier or vendor that either adjusts an invoice, corrects an invoice, or provides a credit you can apply against future purchases. Typically, your supplier will issue credit memos if delivered goods were damaged on arrival or if there was a billing error. Your vendor analysis report shows the total amount that each of your suppliers has billed you over a given period. When viewing this report, you’ll know right away which invoices must be paid first, and you can plan your cash outlays accordingly.

If you are using manual accounting software, then you will have to review the due date of each of the invoices, so you know which invoices are due for payment. Once you’ve reviewed all the invoices, the next step is to process those payments. Generally, QuickBooks provides a list of standard accounts, like accounts payable, accounts receivable, purchase orders, payroll expenses, etc.

Automation can lead to significant cost savings by reducing the need for manual intervention. It minimizes the resources required for processing payments and managing paperwork, ultimately lowering operational expenses. Manual processing of invoices and payments can be time-consuming and prone to errors. With automation, you can streamline these tasks, reducing the time spent on administrative work and freeing up your team to focus on more strategic activities.

The external parties’ stake in the assets of the business (i.e. liabilities) has increased by $200 to $5,200 as a result of this telephone bill that is owing. Automation ensures that data is accurately captured and processed, minimizing mistakes that can occur with manual handling. This leads to more reliable financial records and the credit risk and its measurement hedging and monitoring fewer discrepancies to resolve. Acme posts a debit to decrease accounts payable (#5000) and a credit to reduce cash (#1000). The owner should review all of the documents before signing the check and paying the invoice. Most of the balance on a five-year loan, for example, is categorized as a long-term (noncurrent) liability.

If accounts payable journal entries are not recorded correctly, it can lead to inaccurate financial statements, misrepresentation of liabilities, and incorrect financial analysis. It may also result in payment delays, strained supplier relationships, and difficulty in reconciling accounts. There are a number of duties that the accounts payable clerk performs.

They need to keep a close eye on all the bills to ensure they are paid on time to avoid the fees assessed for payments received beyond the due date. The seller’s account information should be included in the payment voucher that has to be filled out. Before the payment issue voucher can be sent to the vendor, there is sometimes a need for approval in certain businesses. In the context of accounts payable journal entries, liabilities mainly refer to the amounts owed to creditors. Whenever a business makes purchases on credit, the liabilities increase, reflecting in the accounts payable. On the flip side, accounts receivable is the money owed to your business by customers.